Introduction

Brief overview of the stock market

I assume that you are new to the stock market. Befor going futher let me answer the very basic question What is stock market? The stock market is a financial marketplace where individuals or you and institutions can buy and sell a company shares of publicly listed companies or simply called as private limited company(Pvt Ltd).

It plays a major role in the economy by facilitating the exchange of capital between investors and businesses. Companies raise funds for growth and expansion by issuing shares to the public through an Initial Public Offering (IPO), while investors get the opportunity to earn returns through capital appreciation and dividends.

In India, the stock market operates mainly through two major stock exchanges:

- Bombay Stock Exchange (BSE) – Established in 1875, one of the oldest stock exchanges in Asia.

- National Stock Exchange (NSE) – Established in 1992, known for its advanced technology and high trading volumes.

The Indian stock market is regulated by the Securities and Exchange Board of India (SEBI), ensuring transparency, investor protection, and fair practices. Investors can participate in the market through various financial instruments like equity shares, mutual funds, exchange-traded funds (ETFs), and derivatives.

By connecting businesses and investors, the stock market not only helps in wealth creation for individuals but also contributes to the economic growth of the country.

Table of Contents

Importance of the stock market in the economy

I believe the stock market is one of the most important parts of our economy. Stock market acts as a platform where companies can raise money to grow their businesses by selling shares to the public. This money helps businesses expand, create jobs, and contribute to the country’s economic growth.

At the same time, it gives everyday people like us a chance to invest and grow our wealth over time. The stock market also reflects the overall health of the economy—when companies do well, the market rises, showing that the economy is strong. Foreign investors also invest in our market, bringing more money into the country. In simple words, the stock market supports businesses, creates job opportunities, and helps investors build wealth, making it a key driver of India’s economic progress.

Relevance for Indian investors

As someone deeply involved in the Indian stock market, I truly believe that investing in the stock market is highly relevant for Indian investors today. With the rising cost of living and inflation, simply saving money in a bank account is not enough to build wealth.

The stock market offers an excellent opportunity for individuals to grow their money over time by investing in well-performing companies. It allows investors to become part-owners of businesses driving India’s growth story. With more awareness and easy access to online trading platforms, even beginners can start investing with small amounts.

Additionally, long-term investments in quality stocks can help achieve important financial goals like buying a house, funding children’s education, or planning for retirement. For Indian investors, the stock market is not just about making quick profits but about building long-term financial security and wealth.

What is the Stock Market?

Definition of the stock market

As I explained in the previour paragraphs the stock market is simply a place where people can buy and sell shares of companies. When you buy a share, you own a small part of that company. Companies list their shares on the stock market to raise money for their growth, and in return, investors like us get a chance to earn profits if the company does well.

The stock market is not just for big investors; even small investors can start with small amounts and grow their wealth over time. It’s a great platform where businesses and investors come together, helping companies grow and giving individuals an opportunity to achieve their financial goals.

Key functions of the stock market

I believe the stock market serves some very important functions that support both businesses and investors. First, it helps companies raise money for growth by allowing them to sell shares to the public through Initial Public Offerings (IPOs). This money is then used for expansion, new projects, and creating jobs.

Second, it gives investors like us a platform to buy and sell shares, offering a chance to build wealth over time. The stock market also ensures liquidity, meaning we can easily convert our investments into cash whenever needed. Another important function is price discovery, where the value of a company’s shares is determined based on demand and supply.

Lastly, it reflects the country’s economic health, as market movements often indicate how industries and the economy are performing. In simple terms, the stock market connects businesses with investors, creating growth opportunities for both.

Difference between primary and secondary markets

As an Indian stock market invester, I often find that many new investors get confused between the primary market and the secondary market. Let me explain the difference in a simple way through this table:

| Feature | Primary Market | Secondary Market |

|---|---|---|

| Meaning | This is where companies issue shares to the public for the first time. | This is where investors buy and sell existing shares among themselves. |

| Purpose | To raise fresh capital for business expansion and projects. | To provide liquidity to investors by enabling share trading. |

| Type of Transaction | Directly between the company and investors. | Transactions occur between investors (buyer and seller). |

| Instrument Issued | New shares, bonds, or debentures are issued. | Already existing shares are traded. |

| Involvement of Company | The company is directly involved in selling its securities. | The company is not involved; only investors trade. |

| Price of Securities | Price is decided by the company (fixed price or book-building method). | Price fluctuates based on market demand and supply. |

| Example | A company launching an IPO (Initial Public Offering). | Buying shares of Tata Motors or Infosys on NSE/BSE. |

| Risk Level | Higher, as the company is new to the market. | Comparatively lower, as the company is already established. |

In simple terms, the primary market is where companies raise money by selling new shares, while the secondary market is where investors trade those shares among themselves. Both markets are important, but they serve different purposes in the financial system.

Key Components of the Indian Stock Market

What are Stock Exchanges?

As an Indian stock market invester, I often explain to new investors that stock exchanges are organized marketplaces like flipkart and amazon where shares of publicly listed companies are bought and sold. They provide a secure and regulated platform for investors and companies to trade financial instruments like stocks, bonds, and derivatives.

As I mentioned in the previous paragraphs in India, the two major stock exchanges are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

- Bombay Stock Exchange (BSE):- The BSE, established in 1875, is Asia’s oldest stock exchange and is known for its benchmark index, the Sensex, which tracks the performance of the top 30 companies listed on the exchange.

- National Stock Exchange (NSE):- The NSE, founded in 1992, is India’s largest and most advanced stock exchange, famous for its index, the Nifty 50, which tracks the top 50 companies.

Both exchanges play a crucial role in supporting India’s economic growth by offering a safe and transparent environment for trading and investment. Whether you’re a beginner or an experienced investor, understanding how these stock exchanges work is essential for making smart investment decisions.

Need for stock market regulatory body.

I strongly believe that having a regulatory body for the stock market is extremely important to ensure fairness, transparency, and investor protection. Without proper regulation, the market could become a risky place filled with fraud, scams, and manipulation, making it unsafe for investors.

In India, the Securities and Exchange Board of India (SEBI) serves as the regulatory body that oversees and controls the functioning of the stock market. SEBI sets rules for companies, stockbrokers, and other market participants to make sure they follow ethical and legal practices.

It works to prevent insider trading, fraudulent activities, and unfair market practices. This builds trust among investors, encourages more people to invest, and keeps the market stable. In simple words, SEBI acts like a referee in a game, ensuring everyone plays by the rules so that the stock market remains a safe and fair place for all investors.

Market Participants

In the stock market, various participants come together to buy and sell financial instruments, making the market active and liquid. As an Indian stock market invester, I often explain that market participants are broadly categorized into retail investors, institutional investors, and foreign institutional investors (FIIs). Each group plays a unique role in driving the market and contributing to its overall growth.

Retail investors

Retail investors are individual investors like you and me who invest their personal money in the stock market. They usually invest smaller amounts compared to big institutions and often focus on long-term wealth creation or short-term trading.

Retail investors buy shares, mutual funds, or other financial products through brokers or online platforms like Zerodha, 5paisa, Angel One. With the rise of technology and easy-to-use apps, more retail investors in India are now started investing in the Indian market than ever before.

Institutional investors

Institutional investors are large organizations that invest huge amounts of money in the stock market. These include mutual fund companies, insurance firms, pension funds, and banks. Since they invest on behalf of many people, they have more market knowledge and access to advanced research tools. Their large investments can significantly impact the price movements of stocks. In India, mutual fund houses like SBI Mutual Fund and HDFC Mutual Fund are examples of institutional investors.

Foreign institutional investors (FIIs)

Foreign Institutional Investors (FIIs) are investment companies or funds from outside India that invest in Indian stocks and bonds. They bring a lot of foreign money into the Indian market, which helps in market growth and improves liquidity.

However, their large-scale buying or selling can also cause significant ups and downs in the market. ‘When FIIs invest heavily, the market usually goes up, and when they withdraw funds, it can lead to a market decline. Popular global investment firms like Goldman Sachs and Morgan Stanley are few examples of FIIs investing in India.

Understanding these market participants is important because their actions directly impact stock prices and overall market trends. Whether you’re a beginner or an experienced investor, knowing who moves the market can help you make smarter investment decisions.

How the Stock Market Works in India?

Initial Public Offering (IPO) Process

An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time, becoming a publicly traded company. It is a way for companies to raise funds from investors to support their growth, repay debts, or expand operations.

In an IPO, the company sells a portion of its ownership in exchange for capital. For investors, it provides an opportunity to own shares of the company and potentially benefit from its future growth. IPOs are often seen as a milestone for companies, signaling their entry into the broader financial market.

What are the Advantages and Disadvantages of Investing in IPOs

| Advantages | Disadvantages |

|---|---|

| Opportunity for Growth: IPOs allow investors to buy shares at the ground level, potentially benefiting from the company’s growth as its value increases over time. | High Risk: Investing in IPOs is risky as the company’s future performance is uncertain, and its stock price can be volatile. |

| Early Investment Benefits: Early investors may get shares at a lower price compared to when the stock starts trading in the secondary market. | Lack of Historical Data: New companies entering the stock market often have limited historical financial data, making it challenging to evaluate their performance. |

| Diversification: IPOs provide an opportunity to invest in new sectors or emerging industries that may not be represented in an investor’s existing portfolio. | Overvaluation Risk: IPOs can sometimes be overhyped, leading to inflated pricing that may not reflect the company’s true value. |

| Wealth Creation: Successful IPOs can offer substantial returns to long-term investors as the company grows and expands. | Uncertain Market Sentiment: Market conditions or investor sentiment can significantly affect IPO performance, causing unpredictable price movements. |

How companies go public?

The process of an Initial Public Offering (IPO) is how a private company becomes a public company by offering its shares to the public for the first time. In India, companies go public to raise funds for expansion or other business needs.

What is the role of underwriters and book building?

The journey of IPO starts with appointing underwriters, who are typically investment banks or financial institutions that guide the company through the IPO process. They help determine the price of the shares and ensure regulatory compliance. A crucial part of the IPO process is book building, where the underwriters collect bids from investors to assess the demand for the shares. Based on this demand, the final price of the shares is decided.

Once everything is in place, the company lists its shares on stock exchanges like the NSE or BSE, making them available for trading by the public. The IPO process is an essential way for companies to grow while offering investors an opportunity to own a stake in the business.

Stock Trading Mechanism

Online trading platforms

In today’s digital world, online trading platforms have made stock market investing easy and accessible to everyone. These platforms are digital interfaces available as websites or mobile apps that allow investors to buy and sell shares, monitor market trends, and manage their portfolios anytime, anywhere.

Online trading platforms has totaly removed the need for physical paperwork or visiting a broker’s office, making the process seamless and user-friendly. In India, popular platforms like Zerodha’s Kite, Upstox Pro, and Angel Broking’s app are a few offer real-time market data, advanced trading tools, and simple interfaces, enabling both beginners and experienced investors to trade efficiently.

Stock brokers and their role

Stock brokers are intermediaries who connect investors with the stock exchanges, such as the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). They play a important role in executing buy and sell orders on behalf of their clients. In India, brokers are categorized into full-service brokers and discount brokers.

- Full-service brokers, like ICICI Direct and HDFC Securities, provide additional services such as personalized investment advice, research reports, and portfolio management.

- Discount brokers, like Zerodha and Groww, focus on offering lower brokerage fees and essential trading services, making them a cost-effective choice for many investors.

Stock brokers also ensure compliance with regulatory requirements set by SEBI (Securities and Exchange Board of India), ensuring smooth and secure transactions. By offering tools, resources, and support, stock brokers play a key role in helping investors participate confidently in the stock market.

Different Order Types in Trading

What is market order?

A market order is a type of stock market order where you instruct your broker to buy or sell shares immediately at the current market price. It is the simplest and most common way to trade in the stock market. When you place a market order, you prioritize the speed of execution over the price, meaning the trade will be executed as quickly as possible at the best available price at that moment.

For example, if you want to buy shares of a company and place a market order, the broker will purchase them at the price quoted in the market at that time. However, market prices can fluctuate quickly, so the final execution price might be slightly different from what you see when placing the order.

Market orders are ideal when you want to ensure that your trade goes through without delay, especially for stocks that are actively traded and have high liquidity.

What is limit order?

A limit order is a type of stock market order where you set a specific price at which you want to buy or sell shares. Unlike a market order, which executes immediately at the current price, a limit order will only be executed if the stock reaches your specified price or better.

For example, if you want to buy shares of a company but are only willing to pay ₹500 per share, you can place a limit order at ₹500. The order will only be executed if the stock price drops to ₹500 or below. Similarly, if you want to sell shares, you can set a higher price, like ₹550, and your shares will only sell if the price reaches ₹550 or more.

Limit orders give you more control over the price but may not execute immediately, or sometimes not at all, if the market price does not reach your set limit. This type of order is especially useful when you have a specific target price in mind and are not in a hurry to complete the trade.

What is stop-loss order?

A stop-loss order is a type of stock market order that helps protect you from heavy losses by automatically selling your shares if the price falls to a certain level. It acts like a safety net for your investments.

For example, if you own shares of a company currently trading at ₹500 and you want to limit your potential loss, you can place a stop-loss order at ₹450. If the stock price drops to ₹450 or lower, your broker will sell the shares automatically. This ensures you exit the trade before the price falls further, decreasing your losses.

Stop-loss orders are particularly useful in volatile markets, as they help you stick to your risk management plan without constantly monitoring the market. They’re an important tool for both new and experienced investors to protect their investments.

Key Indices in the Indian Stock Market

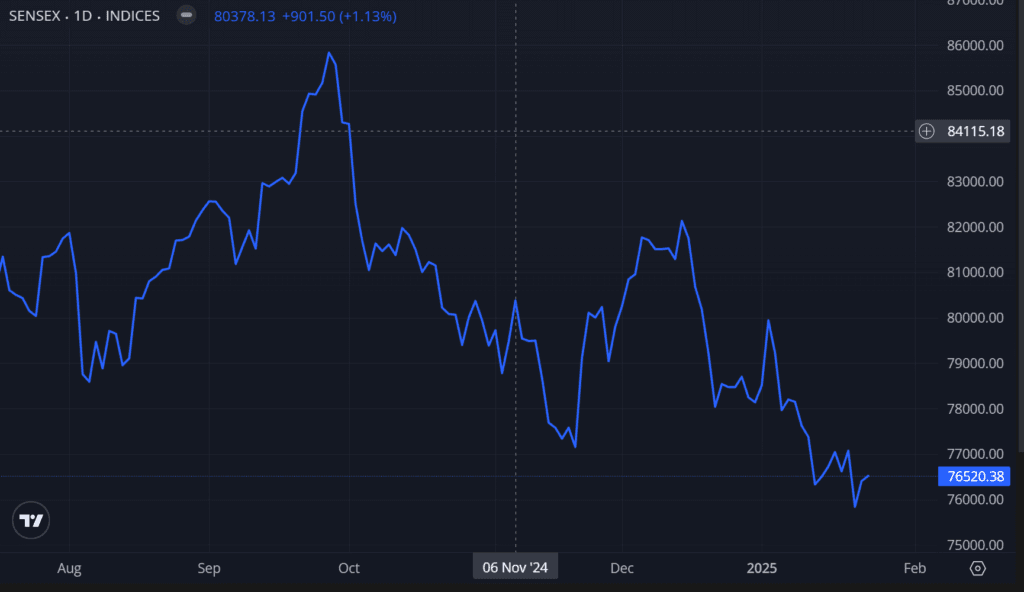

What is Sensex (BSE)?

The Sensex, short for the Sensitive Index, is the benchmark stock market index of the Bombay Stock Exchange (BSE), one of India’s oldest stock exchanges. It represents the performance of the top 30 companies listed on the BSE, which are selected based on factors like market capitalization, liquidity, and sector representation.

These companies are considered leaders in their respective industries and serve as a barometer of the Indian economy. When the Sensex goes up, it indicates that the majority of these top companies are doing well, reflecting positive investor sentiment. Conversely, if it goes down, it suggests that most of these companies are underperforming. The Sensex is widely used by investors to gauge the overall health of the stock market and make investment decisions. It’s like a snapshot of how the market is performing at any given time.

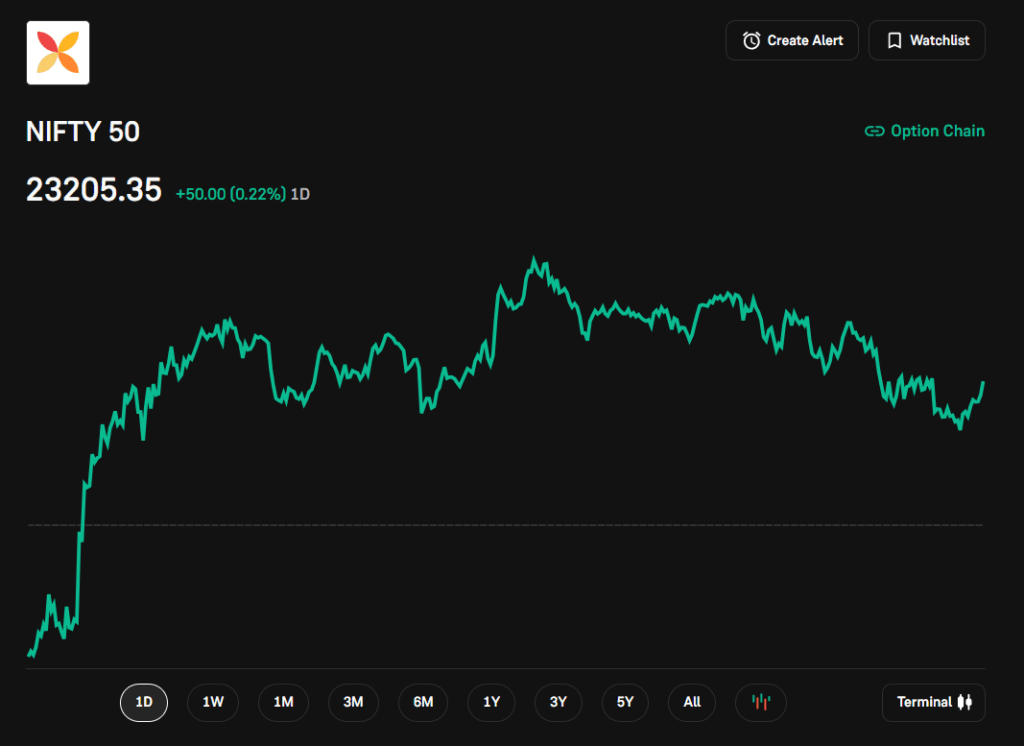

What is Nifty 50 (NSE)?

The Nifty 50 is the benchmark stock market index of the National Stock Exchange (NSE) in India. It represents the performance of the top 50 companies listed on the NSE, chosen from various sectors based on their market capitalization and liquidity. These companies are leaders in their industries and reflect the overall performance of the Indian stock market.

When the Nifty 50 rises, it shows that most of these companies are performing well, signaling positive investor sentiment. If it falls, it indicates that these companies are underperforming. The Nifty 50 is widely used by investors and traders to track market trends, assess economic health, and make informed investment decisions. It’s a key indicator of how the Indian stock market is performing at any given time.

Sectoral indices and their significance

Sectoral indices are stock market indices that focus on specific sectors or industries, such as banking, IT, pharmaceuticals, or energy. Examples in India include the Nifty Bank, which tracks the performance of leading banking stocks, or the Nifty IT, which tracks top IT companies. These indices help investors understand how a particular sector is performing in the stock market.

For example, if the Nifty Pharma index is rising, it indicates strong performance in the pharmaceutical sector. Sectoral indices are significant because they allow investors to focus on industries they believe will grow or to diversify their portfolios by investing in multiple sectors. They are also useful for analyzing market trends and identifying opportunities or risks in specific areas of the economy. For investors, tracking sectoral indices can provide valuable insights to make smarter investment decisions.

Risks and Rewards of Investing in the Stock Market

Advantages of investing in stock market.

- Wealth creation:- Investing in the stock market offers several advantages that can help you grow your wealth over time. One of the biggest benefits is the potential for higher returns compared to traditional savings accounts or fixed deposits. Stocks allow you to become a part-owner of a company, and as the company grows, so does the value of your investment.

- Liquidity:-The stock market also provides liquidity, meaning you can easily buy or sell your shares whenever you need funds.

- Diversification:- Additionally, it offers diversification, allowing you to invest in different industries and reduce risk. Investing in stocks can also help you stay ahead of inflation by generating returns that outpace the rising cost of living. For long-term investors, the stock market is a powerful way to build wealth and achieve financial goals like retirement or funding your child’s education.

- Dividend income:- Dividends are regular payments made by companies to their shareholders from their profits. They provide a steady source of passive income, even if the stock price doesn’t rise significantly. Dividend-paying stocks are particularly attractive for long-term investors as they not only provide income but also signal that the company is financially stable and profitable.

However, it’s important to invest wisely and understand the risks involved.

Risks involved in investing in stock market.

Investing in the stock market comes with certain risks that every investor should be aware of.

- Market volatility:- The most common risk is market volatility, where stock prices can fluctuate rapidly due to factors like economic changes, global events, or company-specific news. This can lead to potential losses, especially in the short term.

- Company-specific risks:- Where a company’s poor financial results or management decisions can negatively affect its stock price.

- Liquidity risk:- The liquidity risk, which occurs when it’s difficult to sell a stock due to low demand.

- Other risk:- Additionally, macro-economic factors like inflation, interest rates, or political instability can impact the overall market.

While the stock market can offer high returns, it’s important to remember that it also carries the risk of losing your capital. This is why it’s essential to invest wisely, diversify your portfolio, and avoid putting all your money in one stock or sector. Always assess your risk tolerance and financial goals before investing.

How to Start Investing in the Indian Stock Market?

Who is a stockbroker?

A stockbroker is a SEBI licensed professional or a firm that acts as a middleman between investors and the stock market. Simply put, they help you buy and sell shares, bonds, or other financial securities on the stock exchange. Since individuals cannot directly trade on stock exchanges, stockbrokers provide the platform and tools to execute these transactions.

They charge a fee or commission for their services. Stockbrokers also offer additional support like research reports, trading tips, and market insights to help investors make informed decisions. In India, stockbrokers are regulated by SEBI (Securities and Exchange Board of India) to ensure fair and transparent practices.

How to choose a good stockbroker?

Choosing a good stockbroker is an important step for successful stock market investing.

- Start by checking if the broker is registered with SEBI, as this ensures they are authorized to operate in India.

- Consider the brokerage charges – some brokers charge a flat fee, while others charge a percentage of your trades. Choose one that fits your budget and trading style.

- Look at the trading platform they provide – it should be user-friendly, reliable, and fast.

- Check the additional services they offer, like research reports, customer support, and mobile app features. If you’re a beginner, go for a broker who offers educational resources to help you learn.

- Finally, read reviews and compare different brokers to find the one that best meets your needs.

Opening a Demat and Trading account

A Demat account, short for “dematerialized account,” is an essential account for anyone looking to invest in the stock market. It allows you to hold your shares and securities in electronic form, making it safe and convenient compared to physical certificates.

To start trading in the stock market, you need both a Demat account (to store your investments) and a Trading account (to buy and sell shares). Opening these accounts is simple and can be done online or through a registered stockbroker.

What are the documents required to open a demat account?

You’ll need a few documents to get started: proof of identity (like your PAN card which will be fetched directly through online process), proof of address (Aadhar fetched directly through online process), a Selfie photo, and a canceled cheque or bank NEFT details for linking your bank account. Once your documents are verified, your accounts are activated, and you’re all set to invest and trade in the stock market!

Stock Market Timings in India

What is Pre-market session?

The pre-market session in the Indian stock market is a short trading window that happens before the regular market opens. It runs from 9:00 AM to 9:15 AM and is divided into three phases. During this time, traders and investors can place buy or sell orders for stocks.

The first phase (9:00 AM to 9:08 AM) is when you can place or modify your orders. The next phase (9:08 AM to 9:12 AM) is for order matching, where the system matches buyers and sellers to determine the opening price of stocks. Finally, the last phase (9:12 AM to 9:15 AM) is for order confirmation.

The pre-market session helps the stock market start smoothly by reducing volatility and setting fair opening prices based on demand and supply. It’s particularly useful for reacting to news or events that happened overnight.

What is Normal trading hours?

The normal trading hours in the Indian stock market are from 9:15 AM to 3:30 PM on weekdays, excluding public holidays. During this time, investors and traders can buy and sell stocks, bonds, and other securities listed on the exchanges like NSE (National Stock Exchange) and BSE (Bombay Stock Exchange).

The market operates on a continuous trading system, where transactions happen instantly based on the demand and supply of stocks. This is the main session where most trading activity takes place, and it is open to retail investors, institutional investors, and traders. It’s important to note that the market remains closed on Saturdays and Sundays. If you’re planning to trade, keeping track of these hours is essential to make timely decisions.

What is Post-market session?

The post-market session in the Indian stock market happens after the regular trading hours, from 3:30 PM to 4:00 PM. During this time, traders and investors cannot buy or sell stocks at live market prices, but they can place orders at the closing price of the stock. This is called the “closing price trading session” or “closing session.”

The post-market session is mainly used by investors who want to make adjustments to their positions based on the day’s closing prices or missed trading during regular hours. It helps bring stability to the market by allowing trades at a fixed price. For beginners, it’s a good way to observe how the market reacts at the end of the day without worrying about live price fluctuations.

Taxation on Stock Market Investments in India

What is Short-term capital gains (STCG)?

Short-term capital gains (STCG) refer to the profit earned when you sell an asset, like stocks, mutual funds, or property, within a short period of time—typically less than 12 months in India.

For example, if you buy shares of a company and sell them within a year at a higher price, the difference between the buying price and selling price is your short-term capital gain.

In India, Short-term capital gains are taxed at a flat rate of 15% (plus applicable surcharges and cess) if the asset is listed on a recognized stock exchange. However, if the asset is unlisted, the STCG is added to your total income and taxed according to your income tax slab. Understanding STCG is essential for investors, as it helps them plan their trades while keeping tax liabilities in mind.

What is Long-term capital gains (LTCG)?

Long-term capital gains (LTCG) refer to the profit you make when you sell an asset, like stocks, mutual funds, or property, after holding it for a longer period—usually more than 12 months in India (for listed stocks and equity mutual funds).

For example, if you buy shares and sell them after one year at a higher price, the profit earned is considered long-term capital gains.

In India, LTCG from listed equity shares and equity mutual funds exceeding ₹1 lakh in a financial year is taxed at 10% without the benefit of indexation. This tax rate is relatively lower than short-term capital gains, making long-term investments a tax-efficient way to grow wealth. Knowing about LTCG is important for investors, as it helps in making informed financial decisions and planning investments wisely.

What is Securities Transaction Tax (STT)?

Securities Transaction Tax (STT) is a tax that the Indian government charges on the buying and selling of securities, such as stocks, equity-oriented mutual funds, and derivatives, on recognized stock exchanges. It is a small percentage of the transaction value and is automatically deducted by the stockbroker when you trade.

For example, if you buy or sell shares, you’ll notice a small amount added as STT in your contract note. The rate of STT varies depending on the type of transaction—for instance, it is higher for selling options compared to buying shares.

STT ensures that the government collects tax directly from traders and investors in a simple and efficient manner. Knowing about STT is important because it is an additional cost that impacts your overall trading or investment profits.

Conclusion

Key points covered

In conclusion, the stock market is a grate platform that connects businesses and investors, facilitating wealth creation and contributing to economic growth. Through this article, we’ve explored the basics of the stock market, its importance in the Indian economy, the key components like BSE and NSE, and the role of SEBI in ensuring a transparent and fair trading environment.

We’ve also discussed how the primary and secondary markets work, the different market participants, and the mechanisms of stock trading, including IPOs, order types, and stock market timings. Additionally, understanding the risks and rewards of investing, taxation, and the advantages of long-term investments are crucial for success.

My point of view on stock market investement.

As an active stock market invester my perspective is, while the stock market offers incredible opportunities to build wealth, it’s important to start with proper research, a clear understanding of market dynamics, and a solid risk management plan. Investing without adequate knowledge can lead to losses, but with the right approach, it can be a powerful tool to achieve financial goals like retirement, education, or buying a home.

For Indian investors, the stock market is not just a way to grow money but a chance to be part of India’s economic journey. By taking a long-term view, diversifying investments, and staying disciplined, you can navigate the ups and downs of the market effectively. If you’re new to investing, begin with small, informed steps, and as you gain confidence, you’ll discover the immense potential of stock market investing. Remember, patience and consistency are key to reaping the long-term benefits of this exciting financial avenue.

Frequently Asked Questions

How the final price of the shares is decided in an IPO?

A crucial part of the IPO process is book building, where the underwriters collect bids from investors to assess the demand for the shares. Based on this demand, the final price of the shares is decided.

What are the minimum requirements to start investing in India?

To start investing in India, you need a PAN card, a bank account, a Demat and Trading account (which can be opened with a SEBI-registered stockbroker), and access to a smartphone or computer with an internet connection. Additionally, completing KYC (Know Your Customer) verification is mandatory. While not required, having basic knowledge of the stock market can help you make better investment decisions.

Can NRIs invest in the Indian stock market?

Yes, NRIs (Non-Resident Indians) can invest in the Indian stock market. They need to open an NRE (Non-Resident External) or NRO (Non-Resident Ordinary) bank account, along with a Demat and Trading account linked to their NRI status. Investments must comply with the guidelines set by the RBI (Reserve Bank of India) and SEBI (Securities and Exchange Board of India). NRIs can invest in equity shares, mutual funds, and IPOs, but certain restrictions apply to sectors like defense, agriculture, and real estate.

What is the difference between BSE and NSE?

The Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) are the two major stock exchanges in India. BSE, established in 1875, is Asia’s oldest stock exchange and is known for its benchmark index, Sensex, which tracks the top 30 companies. NSE, established in 1992, is India’s largest stock exchange by trading volume and is known for its benchmark index, Nifty 50, which tracks the top 50 companies. While both offer a platform for trading stocks, NSE is more popular for derivatives trading, and BSE is known for its historical significance.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please consult a financial advisor before making any investment decisions.