September 8, 2025 – Urban Company, India’s leading tech-driven home and beauty services marketplace, is gearing up for its highly anticipated Initial Public Offering (IPO), set to open for subscription on September 10, 2025. With a robust Grey Market Premium (GMP) signaling strong investor interest, the Urban Company IPO is poised to make waves in the Indian stock market. Here’s everything you need to know about the Urban Company IPO GMP, price band, key dates, and what investors can expect.

Table of Contents

Urban Company IPO Overview

Urban Company, formerly known as UrbanClap, is launching a ₹1,900 crore IPO, comprising a fresh issue of ₹472 crore and an Offer for Sale (OFS) of 13.86 crore equity shares worth ₹1,428 crore. The IPO will be open for public bidding from September 10 to September 12, 2025, with a tentative listing date of September 17, 2025, on the BSE and NSE. The price band is set at ₹98 to ₹103 per share, with a minimum lot size of 145 shares, requiring a retail investment of approximately ₹14,935 at the upper end.

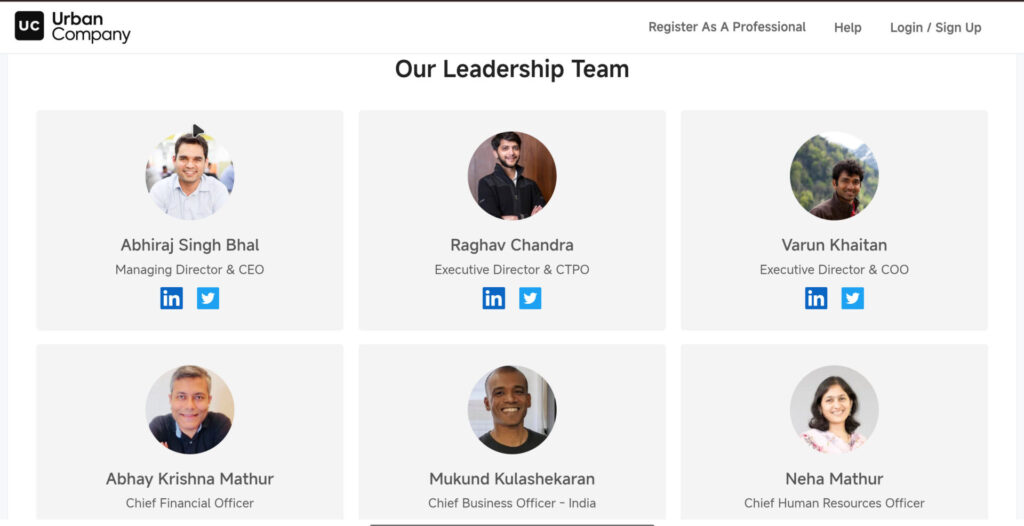

The company, founded in 2014 by Abhiraj Singh Bhal, Raghav Chandra, and Varun Khaitan, operates in 51 cities across India, the UAE, and Singapore, offering services like cleaning, plumbing, electrical work, beauty treatments, and more. Urban Company has also expanded into home solutions with products like water purifiers and electronic door locks under its “Native” brand.

Urban Company IPO GMP Today

The Grey Market Premium (GMP) for Urban Company’s IPO has been trending strongly, reflecting bullish investor sentiment. As of September 8, 2025, the GMP is reported to be in the range of ₹19 to ₹23 per share, indicating an estimated listing price of ₹122 to ₹126 at the upper price band of ₹103. This suggests potential listing gains of 18-22% for investors.

The GMP has shown volatility, with a high of ₹20 on September 4 and a low of ₹0 on September 3, but recent updates indicate a steady rise, driven by strong demand in the grey market. Investors should note that GMP is an unofficial indicator and can fluctuate rapidly once bidding begins.

Financial Performance and Growth Prospects

Urban Company has demonstrated impressive financial growth, making it an attractive investment opportunity. For the financial year 2024-25, the company reported a revenue of ₹1,260.68 crore, a 38% increase from ₹927.99 crore in FY24. It also turned profitable, posting a net profit of ₹239.77 crore in FY25, compared to a loss of ₹92.77 crore in FY24. In the first quarter of FY25, Urban Company recorded a revenue of ₹281 crore (up 37.3% year-on-year) and a profit before tax of ₹12 crore.

The IPO proceeds from the fresh issue will be used for:

- ₹190 crore for technology development and cloud infrastructure.

- ₹75 crore for lease payments.

- ₹90 crore for marketing activities.

- General corporate purposes.

Analysts highlight Urban Company’s strong brand recall, scalable model, and hyperlocal approach as key strengths. The company’s focus on training and supporting its 54,347 monthly active service professionals (as of June 30, 2025) further enhances its market position. However, risks such as high competition, thin margins in certain categories, and dependence on consumer retention remain.

Key IPO Details

- Issue Size: ₹1,900 crore (₹472 crore fresh issue + ₹1,428 crore OFS)

- Price Band: ₹98–₹103 per share

- Lot Size: 145 shares (₹14,935 for retail investors)

- Subscription Dates: September 10–12, 2025

- Allotment Date: September 15, 2025

- Listing Date: September 17, 2025

- Book-Running Lead Managers: Kotak Mahindra Capital, Morgan Stanley India, Goldman Sachs (India) Securities, JM Financial

- Registrar: MUFG Intime India Pvt. Ltd.

- Investor Allocation: 75% for Qualified Institutional Buyers (QIBs), 15% for Non-Institutional Investors (NIIs), 10% for Retail Investors

Should You Subscribe to Urban Company IPO?

Brokerages and analysts are largely optimistic about the Urban Company IPO, citing its leadership in India’s home services sector, strong financial turnaround, and potential for international expansion. Arihant Capital Markets notes that Urban Company’s tech-driven platform and focus on quality professionals give it a competitive edge. However, some caution that the IPO’s valuation appears aggressive, and profitability remains a key risk due to high operational costs.

The GMP’s upward trend suggests decent listing gains, making the IPO attractive for short-term investors. For long-term investors, Urban Company’s growth in the underpenetrated home services market (projected to reach $97.4 billion by 2029) and its scalable model offer compelling reasons to consider subscribing.

How to Apply for Urban Company IPO

Investors can apply through:

- Online: Use UPI or ASBA via brokers like Zerodha, Groww, Upstox, or net banking.

- Offline: Submit physical IPO forms through designated bank branches.

To check allotment status, visit the registrar’s website (MUFG Intime India) or BSE/NSE portals after September 15, 2025.

Conclusion

The Urban Company IPO is generating significant buzz, with its GMP indicating strong listing gains of 18-22%. Backed by robust financial growth, a trusted brand, and a vast market opportunity, the IPO is a promising opportunity for both retail and institutional investors. However, potential risks like competition and valuation concerns warrant careful consideration. Investors are advised to consult with SEBI-registered financial advisors and review the company’s financials before applying.

Disclaimer: This article is for informational purposes only and not investment advice. IPO investments carry market risks. Always consult a financial advisor before making investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please consult a financial advisor before making any investment decisions.