The allotment for the Amanta Healthcare Initial Public Offering (IPO) has been finalized on 04th September 2025, following an overwhelming subscription rate of 82.61 times. The pharmaceutical company, specializing in sterile liquid formulations, saw robust demand across all investor categories during its three-day bidding window from September 1 to September 3, 2025. Investors can now check their allotment status on the registrar’s portal or the BSE and NSE websites, with shares expected to be credited to demat accounts by September 8, 2025, and listing scheduled for September 9, 2025.

IPO Subscription and Allotment Details

Amanta Healthcare’s IPO, aimed at raising ₹126 crore through a fresh issue of 1 crore equity shares, was priced between ₹120 and ₹126 per share. The issue attracted bids for over 578.28 million shares against the 7 million shares offered, reflecting strong investor confidence. The subscription breakdown is as follows:

- Non-Institutional Investors (NII): Subscribed 209.42 times

- Retail Individual Investors (RII): Subscribed 54.98 times

- Qualified Institutional Buyers (QIB): Subscribed 35.86 times

Table of Contents

The high subscription, particularly from NIIs, indicates competitive allotment, with estimates suggesting only 1 out of 45 retail applications and 1 out of 169 small HNI applications may receive shares. The basis of allotment was finalized on September 4, 2025, and investors who did not receive shares will have refunds initiated by September 8, 2025.

How to Check Amanta Healthcare IPO Allotment Status?

Investors can verify their allotment status through multiple platforms, including the registrar’s portal and stock exchange websites. Below are the steps to check the status:

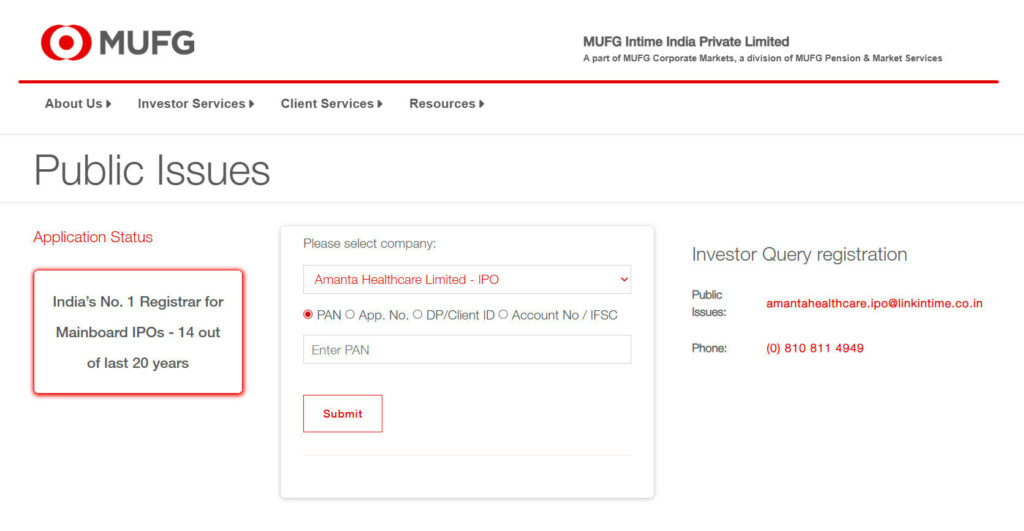

On MUFG Intime India Pvt. Ltd. (Registrar)

- Visit the official registrar portal at https://in.mpms.mufg.com/Initial_Offer/public-issues.html.

- Select “Amanta Healthcare Ltd.” from the dropdown menu (available post-allotment finalization).

- Enter your PAN, Application Number, or DP/Client ID.

- Click “Submit” to view your allotment status.

On BSE Website

- Go to https://www.bseindia.com/investors/appli_check.aspx.

- Select “Equity” under Issue Type.

- Choose “Amanta Healthcare Ltd.” from the Issue Name dropdown.

- Enter your Application Number or PAN.

- Complete the captcha and click “Search” to check your status.

On NSE Website

- Visit https://www.nseindia.com/invest/check-trades-bids-verify-ipo-bids.

- Select “Equity & SME IPO bid details” and choose “Amanta Healthcare Ltd.”

- Enter your PAN or Application Number.

- Submit to view your allotment status.

Grey Market Premium (GMP) and Listing Expectations

As of September 4, 2025, the grey market premium (GMP) for Amanta Healthcare shares stood at ₹8.5, indicating a potential listing price of approximately ₹134.5 per share, a 6.75% premium over the upper price band of ₹126. This is a notable decline from the GMP of ₹28 observed earlier in the subscription period, suggesting moderated expectations for listing gains. Analysts attribute the cooling GMP to market dynamics and high subscription rates, which may temper short-term listing pops but reflect strong long-term investor interest.

About Amanta Healthcare

Founded in 1994 and based in Ahmedabad, Amanta Healthcare is a key player in the pharmaceutical sector, focusing on sterile liquid formulations such as IV fluids, ophthalmic solutions, and respiratory care products. Its state-of-the-art manufacturing facility in Hariyala, Gujarat, spans 66,000 square meters and is WHO-GMP certified, utilizing advanced Aseptic Blow-Fill-Seal (ABFS) and Injection Stretch Blow Moulding (ISBM) technologies. In FY25, the company reported revenue of ₹276.09 crore and a profit after tax of ₹10.5 crore, up 189% from ₹3.63 crore in FY24.

The IPO proceeds will primarily fund capital expenditure, with ₹70 crore allocated for a new SteriPort manufacturing line and ₹30.13 crore for a small volume parenteral (SVP) line at Hariyala, alongside general corporate purposes.

Analyst Insights and Investment Outlook

Analysts have given the Amanta Healthcare IPO a mixed but generally positive outlook. Minerva Capital Research noted the company’s strengths, including an established market position and capacity expansion plans, but highlighted risks such as a high debt-to-equity ratio (2.02) and exposure to volatile raw material prices. The IPO’s price-to-earnings (P/E) ratio of 46.6x based on FY25 earnings is considered elevated compared to its listed peer, Denis Chem Lab Ltd. (P/E of 15.92). Exencial Research Partners recommends the IPO for long-term investors, citing growth potential in India’s sterile injectables market.

Scoop Investment assigned a “Subscribe for Long Term” rating, emphasizing that valuation multiples may improve as the company reduces debt and expands capacity. However, they cautioned that execution delays in capital expenditure could pose risks.

Key Dates and Next Steps

- Allotment Finalization: September 4, 2025

- Refunds and Share Crediting: September 8, 2025

- Listing Date: September 9, 2025, on BSE and NSE

Investors are advised to check their allotment status promptly and monitor market updates ahead of the listing. While the GMP suggests modest listing gains, the company’s strong fundamentals and expansion plans make it a compelling option for long-term investment in the pharmaceutical sector. For further details, refer to the Amanta Healthcare IPO Red Herring Prospectus (RHP) or contact the registrar, MUFG Intime India Pvt. Ltd., at [email protected] or +91-22-4918 6270.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult certified financial advisors before making investment decisions. Investments in IPOs are subject to market risks.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please consult a financial advisor before making any investment decisions.