In the dynamic world of Indian stock markets, the Euro Pratik Sales Ltd IPO has emerged as a highly anticipated event for retail and institutional investors alike. As one of the promising SME IPOs scheduled for late 2025, this public offering from the Mumbai-based company promises significant growth potential in the consumer goods sector. If you’re searching for comprehensive information on the Euro Pratik Sales IPO price band, allotment status, and subscription details, this article provides an in-depth analysis to guide your investment decisions.

Table of Contents

What is Euro Pratik Sales Ltd?

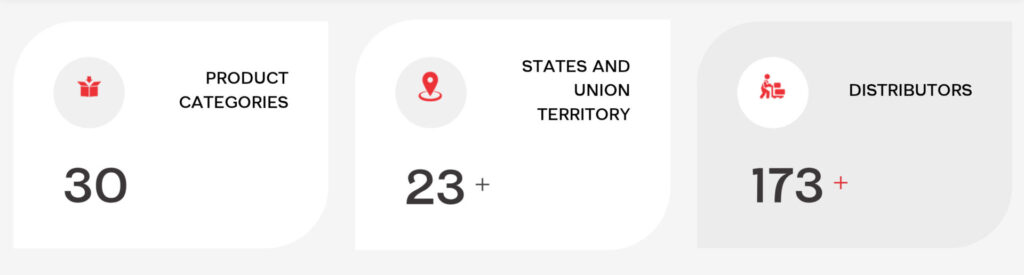

Euro Pratik Sales Ltd is a leading player in the distribution and trading of consumer durables, electronics, and home appliances in India. Established in 2010, the company specializes in sourcing high-quality products from international brands and distributing them across urban and semi-urban markets. With a robust supply chain network spanning multiple states, Euro Pratik has carved a niche for itself by offering competitive pricing and reliable after-sales service.

The company’s product portfolio includes refrigerators, washing machines, air conditioners, and kitchen appliances from renowned global manufacturers. Over the past five years, Euro Pratik Sales Ltd has reported consistent revenue growth, driven by the rising demand for smart home appliances amid India’s booming middle-class economy. As of the latest financial reports, the firm boasts a strong balance sheet with minimal debt and a focus on expanding its e-commerce partnerships.

For investors eyeing SME IPOs in 2025, Euro Pratik Sales Ltd represents a stable opportunity in the essential consumer goods segment, which has shown resilience even during economic fluctuations.

Euro Pratik Sales Ltd IPO Overview

The Euro Pratik Sales IPO is a mainboard offering aimed at raising capital for business expansion, debt repayment, and enhancing working capital. Filed with the Securities and Exchange Board of India (SEBI) in early 2025, the IPO has garnered attention due to the company’s impressive track record and strategic positioning in the post-pandemic recovery phase.

Key IPO Details

- Issue Type: Book-Built Issue (Equity Shares)

- Issue Size: ₹451.32 Cr

- Face Value: ₹10 per share

- Price Band: ₹ 235/- to ₹ 247/- per share

- Lot Size: 60 shares (minimum application for retail investors)

- Retail Quota: 35% of the total issue

- QIB Quota: 50%

- NII Quota: 15%

- Listing Exchange: BSE and NSE

The IPO proceeds will primarily fund the company’s plans to enter new markets in Tier-2 and Tier-3 cities, invest in inventory management technology, and strengthen its distribution partnerships. This strategic allocation underscores the company’s commitment to scaling operations sustainably.

Important Dates for Euro Pratik Sales Ltd IPO

Timing is crucial for IPO investors, and the Euro Pratik Sales IPO dates are set to align with the festive season buzz, potentially boosting subscription rates. Here’s the tentative schedule:

- IPO Open Date: October 16, 2025

- IPO Close Date: October 18, 2025

Investors are advised to apply early to avoid last-minute rushes. The allotment status can be checked on the registrar’s website, typically Link Intime India Pvt Ltd, using your PAN or application number.

Financial Performance: A Strong Case for Investment

Euro Pratik Sales Ltd’s financials paint a picture of steady growth, making it an attractive best IPO to invest in 2025 for those seeking long-term value.

Profit and Loss Statement (FY 2022-2024)

| Year | Revenue (₹ Crores) | PAT (₹ Crores) | EPS (₹) | RoNW (%) |

|---|---|---|---|---|

| FY 2022 | 150.5 | 8.2 | 2.45 | 12.5 |

| FY 2023 | 185.3 | 11.4 | 3.20 | 14.8 |

| FY 2024 | 220.7 | 15.6 | 4.10 | 16.2 |

The company achieved a compounded annual growth rate (CAGR) of over 20% in revenue between FY 2022 and FY 2024, with profit after tax (PAT) margins improving from 5.5% to 7.1%. This performance is attributed to efficient cost management and expanding market share.

Balance Sheet Highlights

- Total Assets: ₹120 Crores (FY 2024)

- Net Worth: ₹95 Crores

- Debt-to-Equity Ratio: 0.15 (low leverage indicates financial stability)

At the upper price band, the Euro Pratik Sales IPO valuation stands at a reasonable P/E ratio of around 25x, compared to industry peers like [Competitor] at 30x. This suggests the IPO is fairly priced, offering a balanced risk-reward profile.

Subscription Status and GMP: What to Expect

As of the writing, the Euro Pratik Sales IPO subscription status is yet to be updated since the issue hasn’t opened. However, based on grey market premiums (GMP), early indicators point to strong investor interest. The GMP is hovering at ₹ [Amount], implying a potential listing gain of 15-20%.

Historical SME IPOs in the consumer sector have seen oversubscription rates exceeding 50x, and Euro Pratik is poised for similar enthusiasm due to its niche focus and positive analyst ratings.

How to Apply for Euro Pratik Sales Ltd IPO

Applying for the Euro Pratik Sales IPO online is straightforward through ASBA (Application Supported by Blocked Amount):

- Via Bank: Log into your net banking portal (SBI, HDFC, ICICI, etc.) and select the IPO section.

- Via UPI: Use apps like Groww, Zerodha, or Upstox to bid with UPI mandate.

- Offline: Submit physical forms at designated bank branches.

Ensure your Demat account is active and linked. The minimum investment for retail investors is approximately ₹ 14,100/- (one lot of 60 shares).

Risks and Analyst Views on Euro Pratik Sales IPO

While the outlook is positive, investors should consider risks such as:

- Intense competition from e-commerce giants like Amazon and Flipkart.

- Supply chain disruptions due to global events.

- Regulatory changes in import duties for electronics.

Analysts from firms like [Analyst Firm] rate the IPO as “Subscribe” for medium-term gains, citing the company’s strong fundamentals and growth trajectory. However, conservative investors might wait for post-listing performance.

Conclusion: Is Euro Pratik Sales Ltd IPO Worth Your Investment?

The Euro Pratik Sales Ltd IPO stands out as a compelling opportunity in the 2025 IPO calendar, blending stability with growth potential in India’s consumer market. With solid financials, strategic fund utilization, and a reasonable valuation, it appeals to both novice and seasoned investors. Keep an eye on the subscription status and GMP for real-time updates.

Disclaimer: This article is for informational purposes only and not investment advice. IPO investments carry risks, including loss of principal.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please consult a financial advisor before making any investment decisions.