The Indian stock market continues to buzz with excitement as September 2025 brings a fresh wave of initial public offerings (IPOs). With the economy showing robust growth and investor sentiment at an all-time high, these upcoming IPOs in India represent diverse sectors from cybersecurity to manufacturing. Whether you’re a seasoned investor or a newcomer eyeing the best IPOs to watch, this guide breaks down the top 5 upcoming IPOs after September 14, 2025. I have cover essential details like open and close dates, issue sizes, price bands, and why they matter—all optimized for your investment research.

From mainboard heavyweights to promising SME plays, these IPOs could offer significant listing gains amid favorable market conditions. Let’s dive in.

Table of Contents

1. TechD Cybersecurity Ltd IPO: Safeguarding the Digital Future

Kicking off the week is TechD Cybersecurity Ltd, a rising star in India’s burgeoning cybersecurity landscape. As cyber threats escalate, this SME IPO taps into the growing demand for robust digital defenses.

Important dates

- Open Date: September 15, 2025

- Close Date: September 17, 2025

- Issue Size: ₹38.99 crore (entirely fresh issue)

- Price Band: ₹183 – ₹193 per share

- Lot Size: Minimum investment of ₹1,38,000 (approx. 720 shares)

- Sector: Information Technology (Cybersecurity Solutions)

- Listing: NSE SME, expected September 20, 2025

Why Watch This IPO?

TechD specializes in advanced threat detection and compliance services, aligning with India’s digital transformation push under initiatives like Digital India. With strong financials showing consistent revenue growth, analysts predict a healthy subscription rate from tech-savvy retail investors. If you’re betting on the IT sector’s resilience, this could be a high-growth pick in upcoming IPOs India 2025.

2. Euro Pratik Sales Ltd IPO: The Laminates Giant Goes Public

As the largest mainboard IPO this week, Euro Pratik Sales Ltd is set to dominate headlines. This offering underscores the construction boom in India, where interior solutions are in high demand.

Important dates

- Open Date: September 16, 2025

- Close Date: September 18, 2025

- Issue Size: ₹451.32 crore (fresh issue + offer for sale)

- Price Band: ₹235 – ₹247 per share

- Lot Size: Minimum investment of ₹14,820 (60 shares)

- Sector: Building Materials (Decorative Laminates and Surface Solutions)

- Listing: BSE and NSE, expected September 23, 2025

Why Watch This IPO?

Backed by Axis Capital, Euro Pratik boasts a strong market share in premium laminates, with exports to over 20 countries. The funds will fuel capacity expansion amid a real estate surge. For investors seeking stability in infrastructure-linked stocks, this stands out among the best upcoming IPOs in the Indian stock market.

3. VMS TMT Ltd IPO: Steel Stronghold in a Booming Economy

VMS TMT Ltd enters the fray with a focus on TMT bars, essential for India’s infrastructure projects. This mainboard IPO arrives at a time when steel demand is skyrocketing due to government spending.

Key Financial Information table of VMS TMT Ltd.

| Particulars | For the three months period ended June 30, 2025 | 2025 | 2024 | 2023 |

|---|---|---|---|---|

| Total Income (₹ in lakh) | 21,339.35 | 77,140.76 | 87,316.86 | 88,205.61 |

| PAT (₹ in lakh) | 857.64 | 1,473.70 | 1,346.84 | 419.53 |

| Net Worth (₹ in lakh) | 8,177.47 | 7,319.00 | 4,651.27 | 3,083.77 |

| PAT Margin (%) | 4.02 | 1.91 | 1.54 | 0.48 |

| EBITDA (₹ in lakh) | 1,948.33 | 4,552.62 | 4,120.29 | 2,190.77 |

| EBITDA Margin (%) | 9.18 | 5.91 | 4.72 | 2.48 |

| RoNW (%) | 10.49 | 20.14 | 28.96 | 13.60 |

| RoCE (%) | 4.52 | 12.79 | 16.70 | 10.94 |

| Debt to EBITDA Ratio | 15.87 | 6.06 | 4.80 | 7.43 |

Important dates

- Open Date: September 17, 2025

- Close Date: September 19, 2025

- Issue Size: ₹148.50 crore (fresh issue of 1.5 crore shares)

- Price Band: ₹94 – ₹99 per share

- Lot Size: Minimum investment of ₹14,950 (150 shares)

- Sector: Metals (TMT Bars and Steel Manufacturing)

- Listing: BSE and NSE, expected September 24, 2025

Why Watch This IPO?

Based in Ahmedabad, VMS TMT has a P/E ratio of around 21.9x, reflecting solid profitability. The proceeds will enhance production capabilities, positioning it well for urban development trends. Steel IPOs like this often deliver strong debuts—keep an eye if metals are your sector of choice in 2025 IPO watchlist.

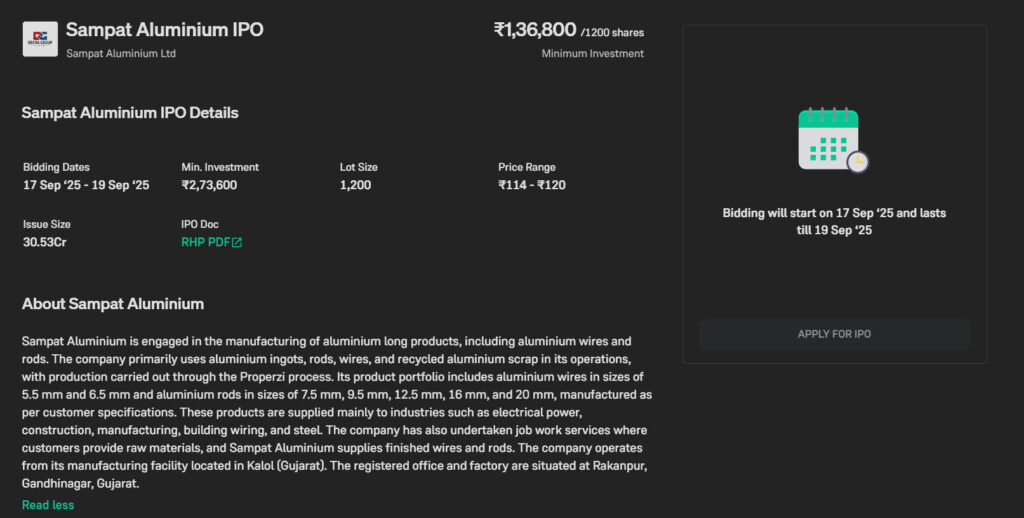

4. Sampat Aluminium Ltd IPO: Lightweight Innovation in Metals

Sampat Aluminium Ltd brings affordability and innovation to the metal processing arena. As an SME offering, it appeals to investors interested in niche manufacturing plays.

Important dates

- Open Date: September 17, 2025

- Close Date: September 19, 2025

- Issue Size: ₹30.53 crore (fresh issue of 25.44 lakh shares)

- Price Band: ₹114 – ₹120 per share

- Lot Size: Minimum investment of ₹1,44,000 (1,200 shares)

- Sector: Metals (Aluminium Products and Processing)

- Listing: NSE SME, expected September 24, 2025

Why Watch This IPO?

With total revenue of ₹148.92 crore in recent years, Sampat focuses on eco-friendly aluminium solutions for automotive and construction. Its low debt and expanding asset base make it a value buy. For diversified portfolios, this rounds out the SME segment in our list of upcoming IPOs India.

5. JD Cables Ltd IPO: Powering Up the Electrical Sector

Rounding out our top picks, JD Cables Ltd targets the electrical infrastructure space, crucial for India’s electrification drive.

Important dates

- Open Date: September 18, 2025

- Close Date: September 22, 2025

- Issue Size: ₹95.99 crore (fresh issue + offer for sale)

- Price Band: ₹144 – ₹152 per share

- Lot Size: Minimum investment of ₹1,15,200 (800 shares)

- Sector: Electrical Equipment (Cables and Wires)

- Listing: BSE SME, expected September 25, 2025

Why Watch This IPO?

A West Bengal-based player, JD Cables has secured borrowings of ₹41.6 crore for growth, with a focus on power transmission cables. Amid rising energy needs, this IPO could see robust demand from infrastructure funds. It’s a timely addition for those tracking energy-related stocks in the latest IPOs 2025.

How to Apply for These Upcoming IPOs in India

Applying for these IPOs is straightforward via UPI-linked ASBA or net banking through brokers like Zerodha, Groww, or Dhan. Monitor subscription status on NSE/BSE sites and check grey market premiums (GMP) for listing insights. Remember, IPO investments carry risks—diversify and consult a financial advisor.

Final Thoughts: Seize the September Surge

September 2025’s IPO pipeline, valued at over ₹750 crore collectively, highlights India’s vibrant capital markets. From TechD’s tech edge to Euro Pratik’s scale, these offerings span growth sectors poised for long-term gains. Stay updated on allotment dates and market volatility to make informed decisions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please consult a financial advisor before making any investment decisions.