In the booming renewable energy sector, Waaree Energies has emerged as a frontrunner, with its share price reflecting robust investor confidence. As of today, September 11, 2025, the Waaree Energies share price stands at ₹3,558.70 on the NSE, marking a 2.33% gain in early trade amid positive market sentiment.

This comes after a stellar 99% rebound from its 52-week low of ₹1,808.65 hit in April 2025, bringing the stock perilously close to its all-time high of ₹3,740.75. For investors eyeing the Waaree Energies share price, this article dives deep into recent performance, core fundamentals, and a forward-looking growth prediction amid India’s solar revolution.

Waaree Energies Share Price: Recent Trends and Market Momentum

The Waaree Energies share price has been on a tear, surging 67% over the past six months and trading at a premium valuation of 47.9 times earnings (P/E ratio). On September 10, it closed at ₹3,477.80, up 6.73% from the previous day, before today’s modest uptick. The stock’s 52-week range spans from ₹1,808.65 to ₹3,740.75, underscoring its volatility but also its multibagger potential—up 86.68% from the low.

Key drivers behind the Waaree Energies share price rally include:

- Q1 FY26 Earnings Beat: Revenue jumped 31.5% year-over-year to ₹4,426 crore, with EBITDA soaring 82% and net profit rising 93% to ₹773 crore. This reflects the company’s dominance in solar module shipments, capturing 17.3% of India’s Q1 2025 market.

- Global Expansion: A $200 million incremental investment in the US, pushing total commitments to $1.2 billion, signals aggressive international plays.

- Sector Tailwinds: India’s push for 500 GW renewable capacity by 2030 fuels demand for Waaree’s solar PV modules.

Technically, the stock shows strength above key supports at ₹3,000–₹3,438, with analysts eyeing resistance near the record high. However, at a price-to-book ratio of 10.6, it’s trading at a steep premium to its book value of ₹330, warranting caution for value hunters.

Waaree Energies: A Quick Company Overview

Founded in 1989 and listed on NSE/BSE in October 2024, Waaree Energies is India’s largest manufacturer of solar photovoltaic (PV) modules, boasting an installed capacity of 13.3 GW as of FY24—up from just 2 GW in FY21. The company operates across the solar value chain, from cell manufacturing to EPC services and even battery storage, with a strong export footprint in the US and Europe.

Waaree’s edge lies in its vertically integrated model, which ensures cost efficiencies and supply chain resilience amid global disruptions. With over 35 years in renewables, it’s not just riding the green wave—it’s shaping it.

Fundamental Analysis: Strong Balance Sheet Powers Waaree Energies

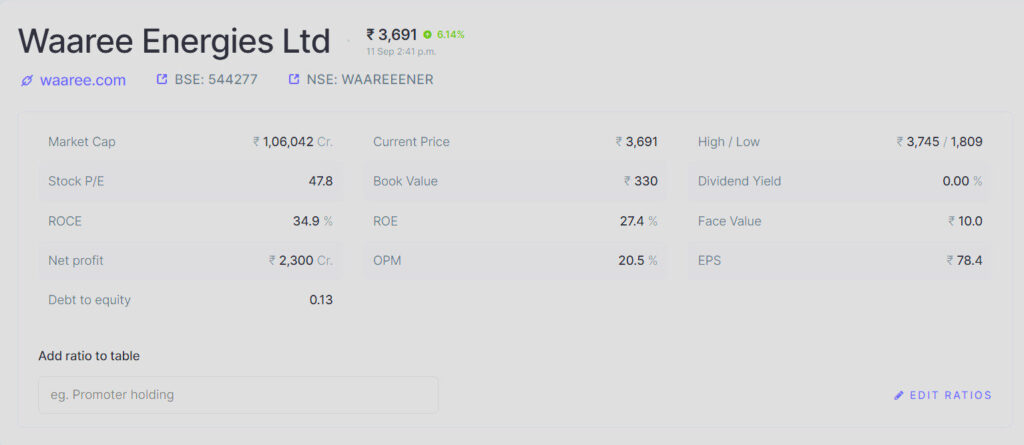

Waaree Energies’ fundamentals paint a picture of a high-growth powerhouse in the solar space. Its trailing twelve-month (TTM) revenue hit ₹15,461 crore, with net profit at ₹2,300 crore, translating to an impressive 15% net margin. Earnings per share (EPS) stands at ₹78.36, underscoring profitability amid rapid scaling.

Here’s a snapshot of key metrics as of March 2025:

| Metric | Value (₹ Cr unless stated) | Notes |

|---|---|---|

| Market Cap | 1,06,250 | Reflects premium valuation |

| Revenue (FY25) | 14,444 | 35% TTM growth |

| Net Profit (TTM) | 2,300 | 105% TTM growth |

| EBITDA Margin | 20% | Up from 16% in Q1 FY25 |

| ROE | 27.4% | Healthy returns on equity |

| ROCE | 34.9% | Efficient capital use |

| Debt | 1,199 | Manageable at 0.52 debt-to-equity |

| P/E Ratio | 47.9 | Elevated but justified by growth |

The company’s profit growth has been explosive—a 113% CAGR over five years—driven by capacity expansions and favorable margins. Debt levels are low, providing flexibility for further investments, while a profitability score of 65/100 highlights operational strength.

That said, the stock’s intrinsic value estimates hover around ₹247–₹330, suggesting it’s currently overvalued by 10–15x on conservative models. Investors should weigh this against sector multiples, where peers like Adani Green trade at similar premiums.

Stock Analysis: Valuation and Risks for Waaree Energies Share Price

From a valuation standpoint, Waaree Energies commands a forward P/E of around 30–35x based on projected earnings, aligning with its 49% five-year sales CAGR. The stock’s beta of ~1.2 indicates moderate volatility, but recent dips (e.g., -5.44% on September 1) show sensitivity to broader market corrections.

Risks include:

- Policy Shifts: Changes in import duties or subsidies could impact module pricing.

- Competition: Intensifying rivalry from Chinese players and domestic peers.

- Execution Delays: Ambitious capex plans (e.g., 6 GW US facility) carry timeline risks.

Despite these, the stock’s momentum—fueled by Q1 beats and analyst upgrades—positions it as a buy for growth-oriented portfolios.

Waaree Energies Future Growth: Bullish Outlook for 2025 and Beyond

Looking ahead, Waaree Energies is primed for accelerated growth, with the global solar market expected to expand at a 23.2% CAGR through 2030. The company’s revenue is forecasted to grow 14.9% annually, supported by ROE projections of 21.4%.

Key catalysts:

- Capacity Ramp-Up: Targeting 3 GW module capacity by FY26 and 5 GW by FY27, plus a new 300 MW electrolyser business for green hydrogen.

- US Market Push: The $1.2 billion investment will scale operations to 5 GW, tapping into IRA incentives.

- Domestic Dominance: As India’s top solar exporter, Waaree benefits from PLI schemes and rising EPC orders.

Prediction: We forecast the Waaree Energies share price to hit ₹4,000–₹4,500 by end-2025, implying 12–26% upside from current levels, driven by 25–30% earnings growth. Longer-term (2026–2030), targets could stretch to ₹6,000+ if expansions execute flawlessly, per UBS’s bullish ₹4,400 call. Nuvama’s ₹3,646 target offers a more conservative 15% buffer, but consensus leans optimistic at an average of ₹3,500–₹4,000.

Final Thoughts: Is Waaree Energies a Buy in 2025?

The Waaree Energies share price trajectory screams opportunity in the green energy boom, backed by ironclad fundamentals and expansive ambitions. While valuations are stretched, the risk-reward skews positive for long-term holders. Monitor quarterly updates and policy winds—Waaree could well be the solar star of 2025.

Disclaimer: This is not investment advice. Consult a financial advisor before trading.

For real-time Waaree Energies share price updates, check NSE India or your brokerage app. What are your thoughts on this solar giant? Share below!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please consult a financial advisor before making any investment decisions.