Bharat Petroleum Corporation Limited (BPCL), a Maharatna Public Sector Undertaking (PSU), has declared a 50% interim dividend for the current financial year.

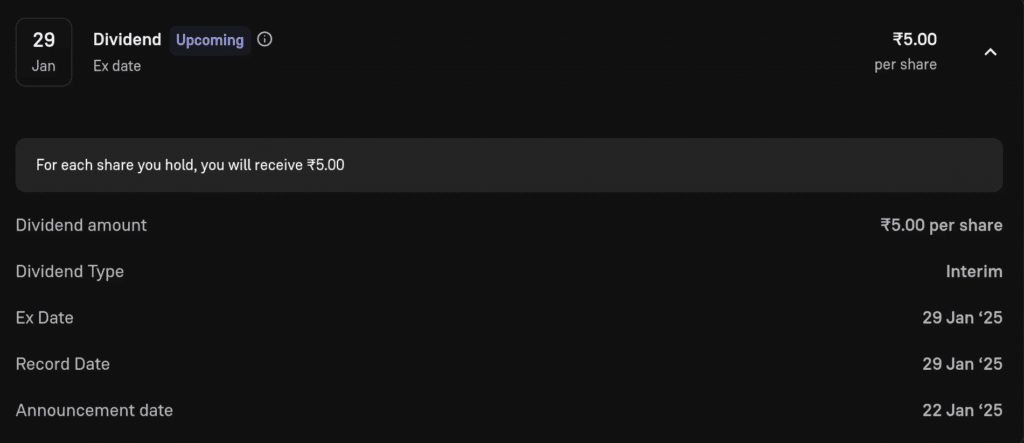

This means shareholders of BPCL will receive Rs 5 per share based on the face value of Rs 10 each. The announcement was made alongside BPCL’s October-December 2025 quarterly earnings and is the first interim dividend that the company has declared this fiscal.

Table of Contents

In an official statement, the company revealed it has fixed January 29, 2025 as the record date. This means only those shareholders whose names appear in the company’s books by the end of January 29 will be eligible for the dividend payout.

To ensure eligibility, investors must purchase BPCL shares before the ex-dividend date, which has been set for January 28, 2025. Any shares bought on or after the ex-date will no longer carry the right to receive the announced dividend.

BPCL also announced that it would distribute the dividend electronically on or before 20th February 2025. Eligible shareholders are advised to confirm that their banking and contact details are up to date with their respective brokerage or Demat service providers to avoid any delay in receiving the dividend.

Dividend History and Significance

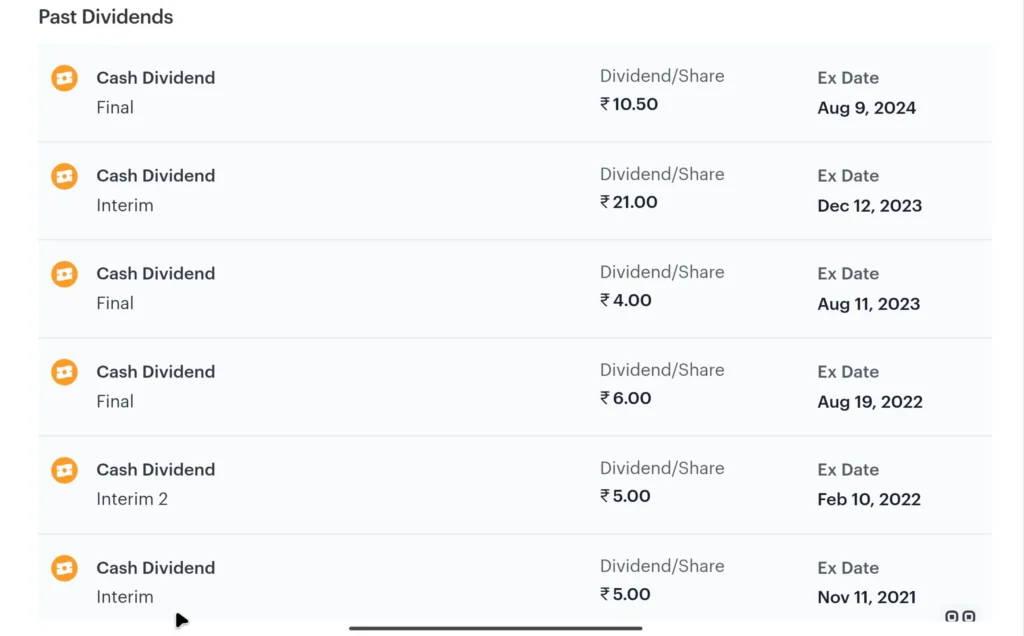

BPCL’s dividend history has been robust, with more than 40 dividend declarations since June 18, 2001. Over the past 12 months, BPCL has paid out an equity dividend amounting to Rs 10.50 per share.

Considering the company’s current share price, the dividend yield works out to around 3.98%, which is relatively attractive for income-focused investors. This consistent dividend policy underscores the company’s commitment to rewarding shareholders and highlights its financial stability over the years.

Market Reaction

BPCL’s stock closed on Friday at Rs 263.80 apiece on the BSE, marking a 2.7 per cent dip for that session. In the past week, it has declined by 3.6 per cent, while in the last two weeks, the stock has dropped by around 5%. Over a longer stretch, BPCL shares have lost 18% in the previous three months and about 16% in the past six months.

Analysts attribute this downward trend to broader market conditions and industry-specific pressures, such as fluctuating crude oil prices and refining margins.

Still, the announcement of an interim dividend can serve as a positive signal for investors, indicating management’s confidence in the company’s performance and balance sheet. Investors who are keen on receiving a regular income from their stock holdings often gravitate towards companies like BPCL, which has a longstanding record of dividend payouts.

Important Dates and Points that Investors Should Know Before Investing?

- Eligibility: To qualify for the interim dividend, individuals must hold BPCL shares in their Demat accounts by the close of trading on January 29, 2025.

- Ex-Dividend Date: Those interested in capturing the dividend must purchase shares before January 28, 2025.

- Payment: BPCL has set February 20, 2025, as the latest date for distributing dividend amounts.

- Dividend Capture Strategy: While some traders might buy shares before the ex-date to collect the dividend and sell immediately after, it’s important to remember that share prices often adjust downward by roughly the dividend amount on the ex-date.

- Long-Term View: For long-term investors, BPCL’s performance and future growth prospects in the energy sector might matter more than the short-term price movements. Keeping an eye on global oil prices, government policies, and the company’s financial health can provide a clearer picture of BPCL’s potential.

My Final Thoughts

BPCL’s 50% interim dividend announcement is likely to draw attention from both existing shareholders and prospective investors looking for dividend income. Although the share price has seen some recent declines, the company’s history of rewarding investors and its Maharatna status could make it a noteworthy consideration for those with a long-term horizon.

As with any investment, individuals should conduct their own research or consult a financial advisor to determine if BPCL aligns with their risk appetite and financial goals.

Other Dividend News

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please consult a financial advisor before making any investment decisions.